Auditing and accounting services in Qatar

Maximizing business potential efficiently and cost-effectively

Solution For All Businesses

Nasser Al Jhira Chartered Accountants Office

a local accounting consultancy firm in Qatar. Services provided by the firm include Statutory, Accounting & other professional services. The firm is led by a highly qualified and experienced team of professionals who are dedicated to providing services of the highest standard and quality. Al Jhira Chartered Accountants office is fully equipped and caters to a wide range of clients including individuals, corporate entities and organizations of various sizes, both domestic and multinational. Al Jhira office is a major and trusted player in Qatar rapidly expanding economic environment. We endeavor to provide outstanding professional services, and we adhere to the latest international standards, remaining continuously abreast with the latest developments in our field. Our aim is to provide cost e active and e client professional services to the business community as well as enabling them to realize the maximum potential of their business. We appreciate the importance of timely implementation of our assignments, committing to time schedules that we share at the commencement of each assignment.

Nasser Al Jhira office adds value beyond the audit

Our audit and assurance services can help organizations see further and deeper into their businesses. From enhancing trust in the companies, we audit to assisting organizations in meeting the assurance demands outlined in regulations and standards. An audit is more than an obligation, it’s a powerful lens for illuminating the current state of an enterprise, providing insight that can inform future aspirations.

Transform your business by outsourcing your finance needs to us. From cash flow forecasting to management accounts, we handle it all, giving you more time to focus on what you do best.

Our Services

Financial Consulting

Tax Consulting

Economic Consulting

Account Auditing

Bookkeeping

Feasibility Studies

We’re Here to Help You

Manage your Business

Account Auditing

Auditing is an essential part of risk management and ensuring business transparency. It involves examining and evaluating a company's financial records and accounting information to ensure accuracy and reliability. The audit includes reviewing financial statements, verifying compliance with accounting standards and state laws, and offering recommendations to improve financial processes.

Main objectives of the audit process:

- Detect errors: Identify potential mistakes or manipulations in financial records.

- Ensure data accuracy: Guarantee that the financial records reflect the company’s actual financial status.

- Improve processes: Provide suggestions to enhance financial systems and procedures.

- Build trust: Increase investor and shareholder confidence in the financial information presented.

Bookkeeping

The process of recording a company’s financial transactions (assets, liabilities, revenues, costs, and expenses) in an accounting system according to accounting principles, and summarizing them in a way that stakeholders can evaluate the company’s financial matters and make appropriate decisions.

Objectives of bookkeeping:

- Record all financial transactions as they occur in the company.

- Classify and categorize financial transactions.

- Extract the company's operational results and its financial position.

- Assist management in making informed decisions.

- Provide information that serves the needs of both internal and external stakeholders.

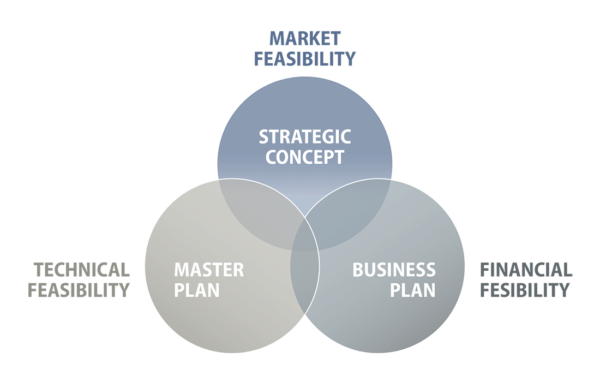

Feasibility Studies

A comprehensive study of all the managerial aspects related to a project (legal, marketing, technical, financial) by gathering and analyzing data to determine whether or not to proceed with the project. This reduces the likelihood of project failure if the investment decision is sound and prevents capital waste by identifying the necessary costs for establishing the project.

Objectives of the feasibility study:

- Determine the technical and financial costs required to establish the project.

- Calculate the amount of capital to be invested, whether fixed or working capital.

- Estimate the direct and indirect costs of implementing the project, as well as variable, fixed, administrative, and depreciation costs.

- Assess the project’s profitability and determine whether it is a profitable venture or not, along with the profit rate in relation to the invested capital.

- Estimate the expected income and compare it with the costs, then extract net profit estimates for each year of the project’s operation.

Tax Services

Registering the business on the tax platform to avoid financial penalties and submitting tax requests in their various forms

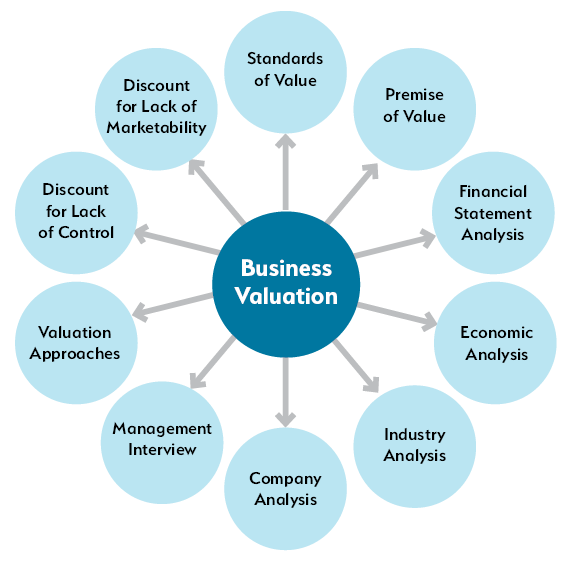

Economic Valuation of Companies

This involves assessing the financial status of a company in the market and arriving at a suitable description of the company's condition. The evaluation helps provide the fair market value of the company.

Objectives of economic company evaluation:

- Provide accurate information on the company's performance.

- Identify new investment opportunities.

- Estimate the value added by the company's unified performance approach.

Arbitration Experts in Qatari Courts

This refers to an agreement to resolve disputes that have arisen or will arise between parties in a specific dispute through arbitrators chosen by the parties involved, rather than going through the judiciary.